Consolidate your investment portfolio, advises Certified Financial Planner David Luke. “The most valuable assets we have are our health and our time.”

By Kathy Penner

For many of us, our first experience with saving money involves stashing our allowance or chore money into a piggy bank. Later on, we open our first savings account and learn what earning interest means. As young adults, we face the challenges of saving while supporting ourselves on limited income and paying back student debt. Then as adults, our careers truly get underway, and we begin to explore how to invest in our future.

Fast forward to older adulthood, when many folks discover they’ve gone a little overboard spreading their investments around. They may now be overwhelmed, trying to keep track of (never mind properly manage) registered retirement plans, pension plans, mutual funds, TFSAs, stocks or other assets—all of which are now being handled by different professionals at two or more banks or investment firms.

The good news is that it’s not hard to save time and money and still reach your financial goals by consolidating your portfolio with one trusted financial planner.

The number of accounts any individual should keep active varies, but reducing it to the bare minimum gives you greater clarity and control. Consolidated accounts will make it easier for your Power of Attorney, spouse or children if they must take over managing your finances at some point—and for the executor of your estate after you pass away.

According to Certified Financial Planner David Luke, principal at 360 Private Wealth Management and advisor at Manulife Securities, “The most valuable assets we have are our health and our time, and the amount of time invested in dealing with more than a couple of advisors and multiple assets does not often generate better results than dealing with a single advisor and a simpler portfolio.”

Recent News

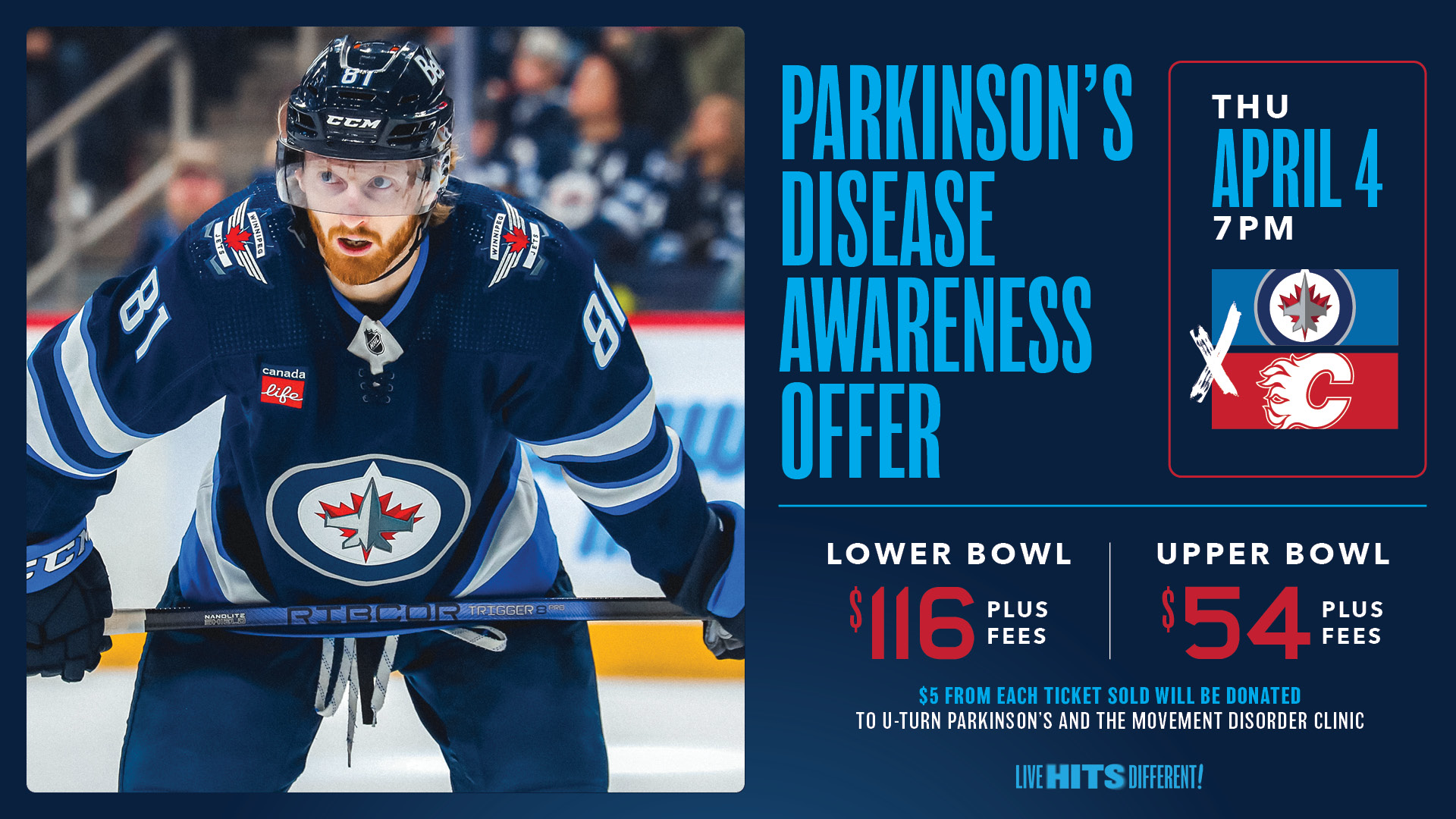

Embracing Hope: The Impact of DLC’s Movement Disorder Clinic

Winnipeg Jets Parkinson’s Disease Awareness Game!