Setting up a Power of Attorney protects you and your loved ones from financial incompetence or abuse

By Kathy Penner

You’ve drawn up a will. You may also have a healthcare directive, or living will. Such documents bring you peace of mind, knowing that your family, executor, healthcare providers and others are clear on your wishes. Yet relatively few people set up a Power of Attorney (POA) document that designates someone to handle their financial affairs, should they become unable to do so themselves.

If you don’t put a Power of Attorney document in place while you can still understand its implications and choose a trusted attorney, you leave yourself and your loved ones vulnerable to losing everything later on through financial incompetence or abuse.

Some people avoid setting up a POA directive because they think they’re giving up control over their finances the minute the POA is drawn up, signed and notarized.

The good news is that this is not the case. Most POA documents contain a springing clause or clauses, outlining what must happen before authority over your finances is transferred to someone else. A springing clause might state that one or more doctors must attest that you (the donor) are no longer mentally competent to handle your own affairs. Another type of springing clause allows you to sign over authority to another person (the attorney) at any time, as long as you are still mentally competent. Some people will do this if they’re struggling to keep everything straight, or if their late spouse used to handle the finances and they’re not confident doing it themselves.

Resources are available to help you learn more about setting up a Power of Attorney, including Manitoba’s Public Trustee and Guardian (www.gov.mb.ca/publictrustee/) and the Community Legal Assistance Association (www.communitylegal.mb.ca/). However, it’s strongly advised that you consult a lawyer to ensure you receive advice and guidance that’s right for you.

Recent News

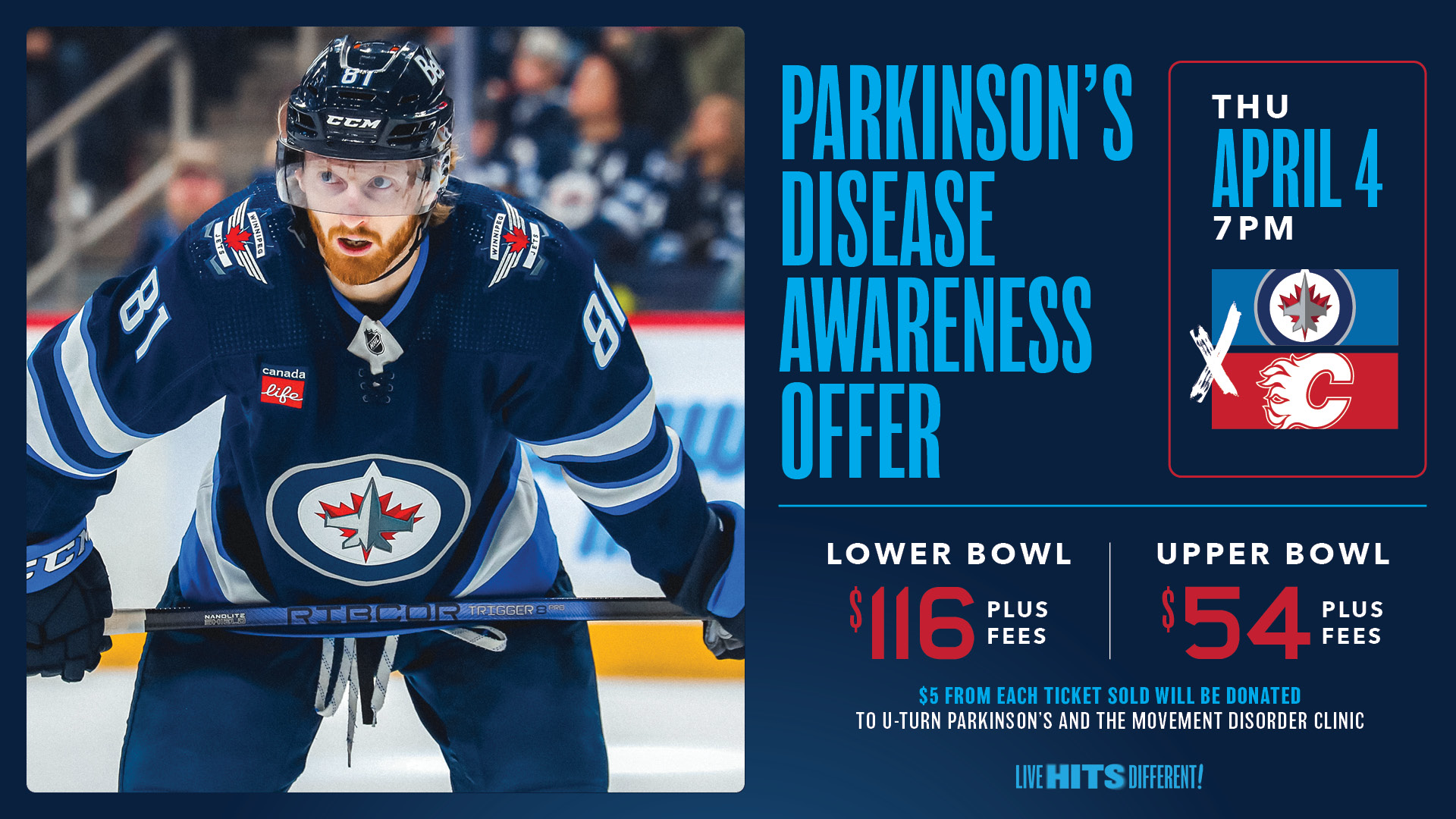

Embracing Hope: The Impact of DLC’s Movement Disorder Clinic

Winnipeg Jets Parkinson’s Disease Awareness Game!